Facts About Stonewell Bookkeeping Revealed

Table of ContentsMore About Stonewell BookkeepingNot known Details About Stonewell Bookkeeping The Ultimate Guide To Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingThe 30-Second Trick For Stonewell Bookkeeping

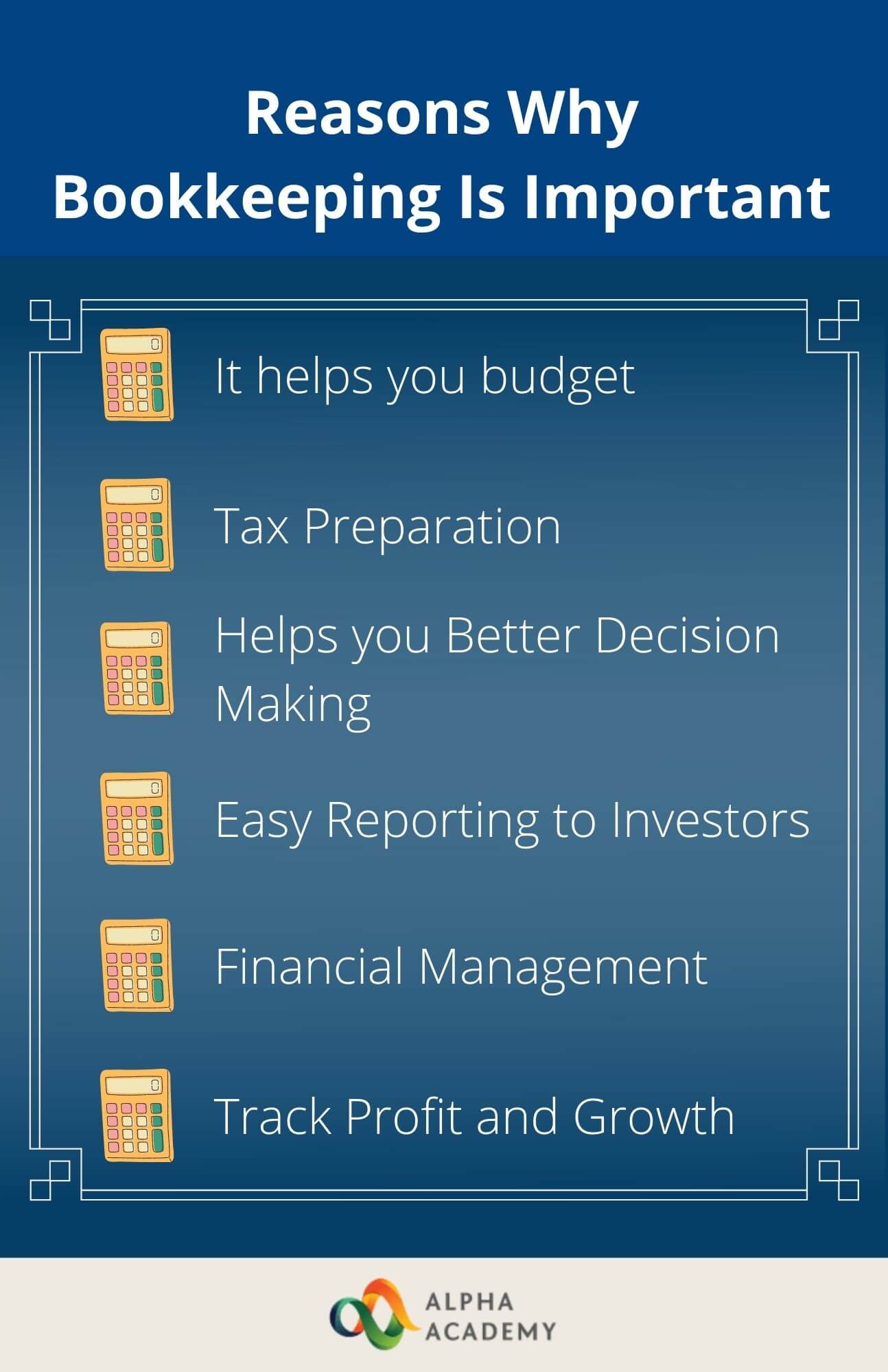

Rather of going with a filing cabinet of various documents, billings, and receipts, you can provide detailed documents to your accountant. After utilizing your accountancy to file your tax obligations, the IRS may pick to carry out an audit.

That financing can can be found in the kind of owner's equity, grants, service finances, and capitalists. But, financiers require to have an excellent concept of your service before investing. If you don't have audit records, investors can not establish the success or failing of your company. They need current, precise details. And, that info needs to be readily obtainable.

An Unbiased View of Stonewell Bookkeeping

This is not meant as lawful guidance; for even more info, please go here..

We addressed, "well, in order to understand exactly how much you require to be paying, we require to recognize just how much you're making. What are your earnings like? What is your take-home pay? Are you in any type of financial obligation?" There was a lengthy time out. "Well, I have $179,000 in my account, so I think my take-home pay (profits much less costs) is $18K".

The Stonewell Bookkeeping Statements

While it might be that they have $18K in the account (and even that could not be real), your equilibrium in the bank does not necessarily identify your profit. If somebody received a give or a finance, those funds are not considered profits. And they would not work right into your revenue statement in determining your earnings.

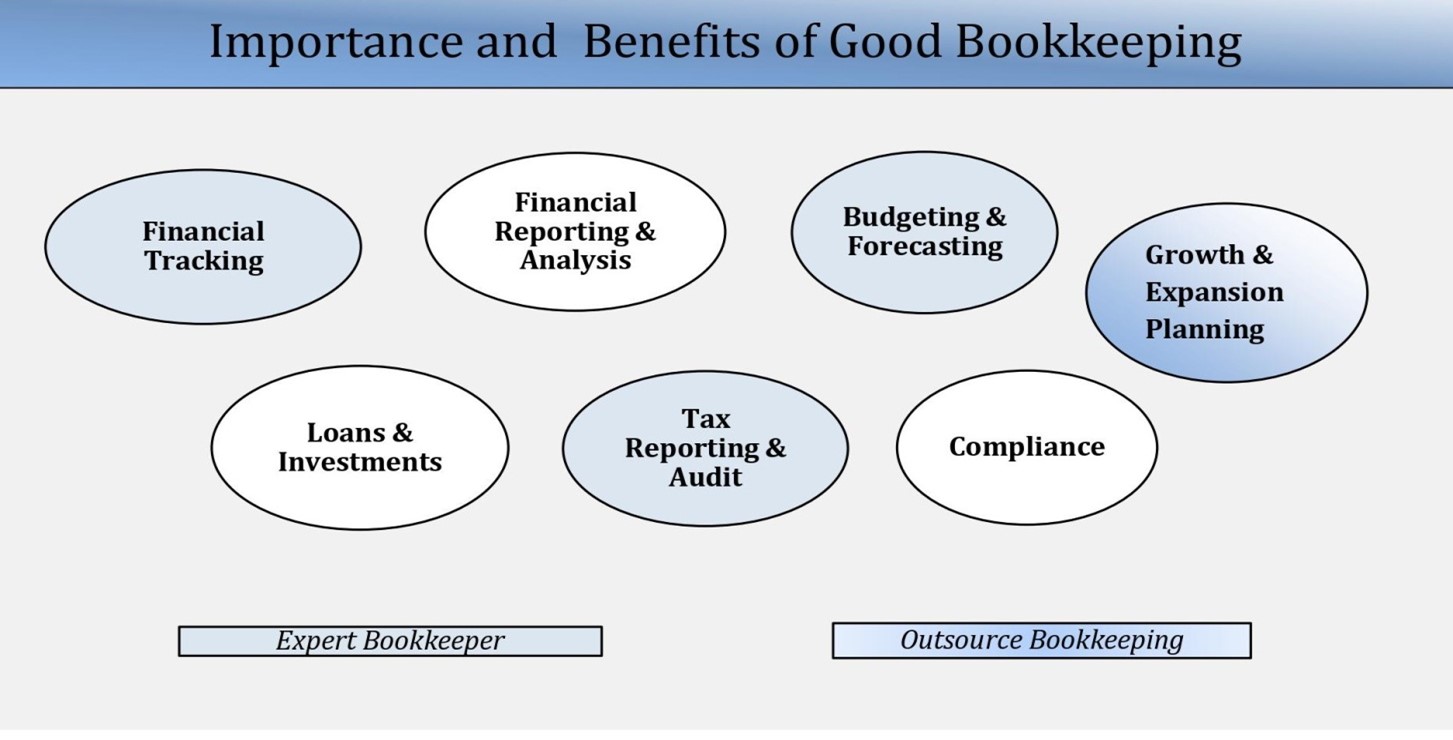

Many points that you assume are expenditures and deductions remain in truth neither. A correct set of books, and an outsourced accountant that can properly categorize those transactions, will certainly help you determine what your organization is really making. Accounting is the process of recording, identifying, and arranging a business's monetary deals and tax filings.

An effective organization calls for aid from specialists. With realistic objectives and a proficient bookkeeper, you can conveniently deal with obstacles and maintain those fears away. We're here to aid. Leichter Audit Providers is an experienced CPA firm with an interest for accountancy and dedication to our clients - Accounting (https://stonewell-bookkeeping.mailchimpsites.com/). We devote our power to ensuring you have a strong monetary foundation for development.

The Single Strategy To Use For Stonewell Bookkeeping

Accurate bookkeeping is the backbone of good economic management in any kind of organization. It aids track income and expenditures, making certain every transaction is tape-recorded correctly. With excellent accounting, companies can make far better choices because clear financial documents offer useful data that can guide method and increase profits. This info is vital for long-lasting planning and forecasting.

Exact economic declarations develop count on with lenders and financiers, enhancing your chances of obtaining the funding you need to expand., organizations must on a regular basis resolve their accounts.

A bookkeeper will certainly cross financial institution statements with interior documents at least once a month to discover blunders or variances. Called bank reconciliation, this procedure assures that the economic records of the firm suit those of the bank.

Cash Money Circulation Declarations Tracks cash motion in and out of the service. These records help company proprietors recognize their financial position and make notified decisions.

Stonewell Bookkeeping for Beginners

While this is cost-effective, it can be time-consuming and vulnerable to errors. Devices like copyright, Xero, and FreshBooks enable business proprietors to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and financial coverage.